Top 5 Senior Fraud Scams and How to Keep Yourself Safe

As the New Year brings change, delight and hope for a better 2020, it can be easy to fall prey to a scam that promises “a better life”. Whether you are in Edmonton, St. Albert, suffering from dementia or are a caregiver, no one is immune to scams. According to the American Journal of Public Health, 5% of the elderly population suffer from scams every year. Though the number may seem low, it nearly equates to 2-3 million people and is likely underestimated. This is due to most internet scams going unreported or, simply, victims not knowing they have been scammed in the first place. As researched by the Government of Canada, it is estimated that only 5% of scams get reported to the police, thus, reducing the evidence and information that can be used to catch the perpetrators. This due to most victims feeling embarrassed they fell for a scam or believing that they did not lose enough money to warrant a report. The greatest issue is that most people who are scammed have the perception that it is not a real crime and not worth the time of law enforcement agencies. Of course, this is incorrect and being scammed is nothing to be ashamed of as it happens to the best of us. However, there are protections and laws in place to protect Canadians from fraud. If you have been scammed the best thing you can do is to report it to your local police (911) or call the Canadian Antifraud Centre (1-888-495-8501). Regardless of your experience, reporting the crime can help the authorities gather more evidence to take down scammers and help you and other Canadians in the process.

Why Are the Elderly Targeted?

Unfortunately, scamming the elderly is far too common but is inherently not their fault. Senior scamming is a multibillion-dollar industry that prey on retirement funds and government benefits of seniors. Scammers know to target seniors as they are often home to answer the phone or door during the day, have reduced internet and technological prowess, and are largely trustworthy. Some even suffer from health issues such as Alzheimer’s or Parkinson’s disease that affect cognition and memory which makes them easy targets for scammers. From January 2014 to December 2017 Canadians alone lost more than $405 million dollars to fraud. Specifically, for Canadians aged 60 to 79, an estimated loss of $94 million dollars was due to scams in the same time frame.

Isolation

Loneliness is common in seniors as they are often cut off from their friends and family. Even the recently retired have trouble adjusting to a life that does not involve work or constant social interaction. This is the perfect breeding ground for scammers as it can be easy for them to establish a relationship with a senior. This is especially traumatic if a senior doesn’t have the ability to consistently access their financial accounts- making it too late when a loved one finds out about the scam in the future.

Financial Situation

A senior’s financial situation is usually why scammers target seniors in the first place. As mentioned above, retirement funds and government benefits are particularly attractive to scammers. In this case, seniors are less strict with their money and will hand it out more easily. Scammers posing as “grandson” or “daughter” looking for money are more likely to get what they ask for. On the hand, seniors that are financially insecure are more prone to “get rich quick schemes” such as pyramid schemes or fake marketing opportunities. Instead of getting what is promised, the senior is trapped by a fraudulent company that never pays out the money promised or ropes them in to pay off a never-ending debt.

Insecurities

In some cases, the elderly gets bullied into handing over their money to scammers. A scammer may particularly target a senior’s own personal insecurity of age, health, social status or finances to use as leverage. Pretending to withhold finances, insurance and/or government benefits until a short fee is paid is typical of scam artists.

Types of Scams that Target Seniors:

Whether its petty criminals trying to steal your identity or simple telemarketer scams, it’s best to keep yourself up to date with the best ways to keep yourself safe! Remember, sometimes paying a small fee can be all a scammer needs to get access to more information. From social security numbers to bank records, scammers can use everything and anything to take what they can get.

Here’s a list the top 5 senior fraud scams plaguing society and what you can do to protect yourself.

1. Phishing (internet)

-Pop-up ads, fake websites, texts or emails that get you to share personal information

Types of Phishing:

Malware Emails:

-Emails that ask you to download something or the download starts once you open the email. Whatever you download damages your computer installing ransomware allowing hackers to search through everything on your computer (tax files, retirement accounts, etc.).

Solution:

-If you think an email is bogus do not open it and delete it immediately. Remember, if you don’t open the email, nothing can download.

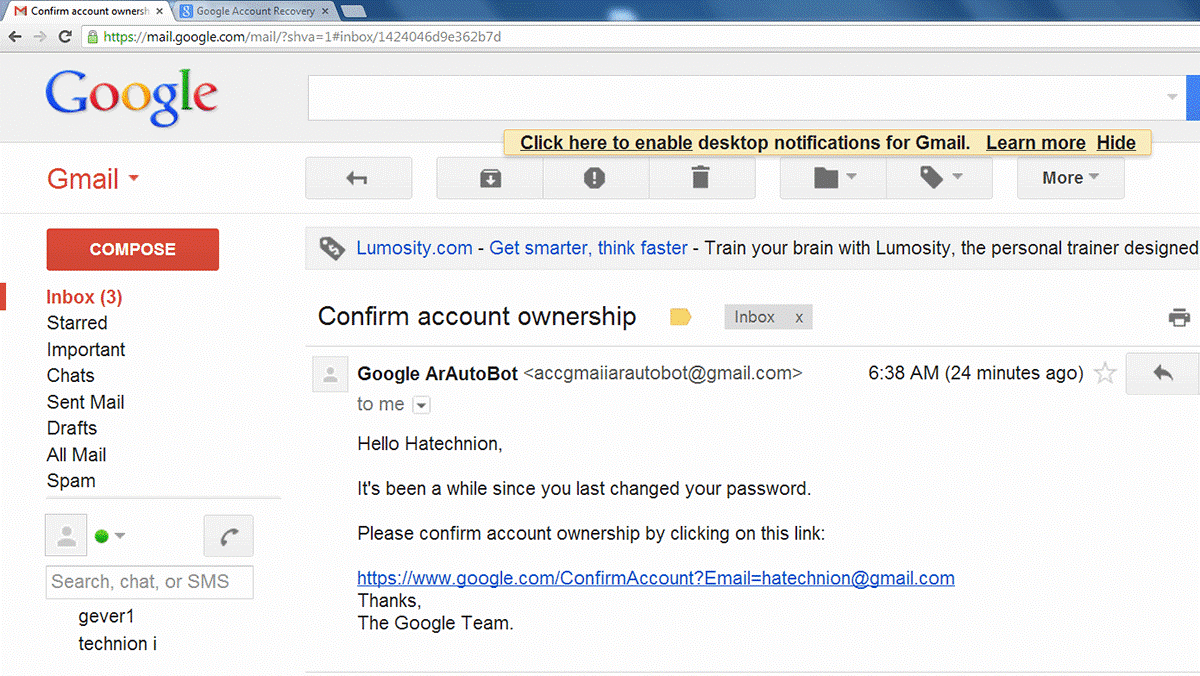

-Scammers will often mimic emails from legit organizations to get you to open the email.

-If you are unsure if an email is bogus or not, double check accounts from your bank, Apple, Netflix etc, to see if the account is set up with that email.

-Check the email address of who sent it and the email subject. If the sender is unfamiliar or doesn’t match a specific company’s address it is probably malware.

-If an email asks for “urgent action required” it is malware. Remember, if there is actually “urgent action” required, you can go to the official website of that company to make any changes. Companies will never ask you to share highly sensitive information via email.

-Malware emails are usually ridden with spelling mistakes and grammatical errors giving you a hint that the email is fraudulent.

-Try to use email organizations such as Gmail or Outlook as they are now fitted with virus scanning that flag malware emails under spam.

If you do open a Malware email:

-Immediately disconnect your device from the internet. If you are using a wired connection, unplug the ethernet cord from your computer. If on a mobile device go to settings and turn on airplane mode or disconnect from Wi-Fi/cellular data. Unplug your Wi-Fi router if possible. This will reduce the risk of the malware spreading to other devices on the network and accessing your device.

-Back up your files on a USB stick or external hard drive. Backing up files does not need an internet connection so any local files saved to a device can be transferred. Luckily the cost of external hard drives/USB sticks are cheap and easy to acquire.

-Scan your system for malware. If you have an anti-virus program, run a complete scan of the system. Follow the steps as intended (you do not need Wi-Fi to run a scan). If you do not have anti-virus software take your device to a professional (Memory Express, Staples, Best Buy).

-Change your online and device passwords immediately.

Check out an example of a malware email below:

Fake Sweepstakes/Lotteries:

-Winning entrees/tickets for fraudulent sweepstakes or lotteries.

-Look like bright, loud, annoying advertisements that pop up on a screen saying you won money by hitting a milestone/random winner.

-Asks you for credit card information to transfer you the money.

-Sometimes ask for your mailing address so they can send a cheque for a “small fee”.

Check out an example of a fake sweepstakes below:

Solutions:

-Online lotteries are always fake. Avoid them completely.

-Legitimate lotto corporations are widely advertised on TV and are available at gas stations and casinos. If you do want to buy a lotto, make sure you buy it from a widely known lotto organization (6/49, Lotto Max, Mighty Millions).

-If you want to enter an online sweepstakes, make sure its from a legit organization. If you are unsure ask your family, friends or even a Senior Home Care by Angels caregiver.

Free/highly inexpensive Vacations:

-Vacation is advertised as a great deal to a tropical or popular destination.

-The property they advertised doesn’t exist or is photoshopped to look real.

-The ad will ask for a down payment on the deal as there is only “limited spots left!”.

-Those who go through with the deal find that the property doesn’t exist or may not look like it did in the photos.

-This can be extremely dangerous as scammers who lure people to these destinations. have been linked to human trafficking, cartels, or other gang related activity.

Solution:

-A good rule of thumb is to remember nothing is ever free.

-Do your research. Check credible vacation websites like Expedia, Booking, or Trivago for the same deals. If they exist on those sites, book with them instead.

-In a world of deep fakes and Photoshop, most photos/ads can be altered. Be conscious of what you see, if something seems off to you, trust your gut, because it probably is.

Be sure to be on the lookout for other scams such as counterfeit prescription drugs, fake anti-aging products, fake credit card advances, and homeowner scams. For more information visit the resources section at the bottom of this post.

2. Emergency Scam- Grandparent Scam

-This scam involves receiving a call, text or email from someone pretending to be a grandchild or daughter/son. The scammer asks for money to resolve an unexpected financial problem.

-Voice modifications or child recordings are used make the scam seem more believable and dire.

-The scammer will ask for money to be sent immediately so they can get out of the situation. Secondly, they will ask for the grandparent to not tell the parents as to “not get in trouble”.

-The money is sent through a transfer service (e-transfers, moneygram, etc), or through pre-paid gift cards, credit cards or bitcoins (online money).

-In 2016, 800 Canadians lost more than a million dollars to this scam.

Solutions:

-Hang up. If you feel that the phone call is fraudulent, it probably is, hang up the phone and don’t deal with it. Report the number to the authorities and block the number from contacting you again.

If it escalates:

-If they ask if you know who this is, say no and make them identify themselves.

-If it is a grandchild reaching out to you, ask for their credentials. Ask about memories only you two would know, ask for their name, parents names or other questions to distinguish that it is truly them. As a lot of information can be found on social media, ask as specific questions as possible, ones that are exclusive to you and your grandchild.

-If you are receiving a phone call that you don’t recognize, it is most definitely not a family member. Remember, if you have a contact list on your phone, their name will pop up when calling.

-If they are asking to not tell their parents, be responsible and tell them. It’s better to be safe than sorry and, most importantly, it will verify the story.

-Sometimes the scammer will put on another voice pretending to be a police officer, lawyer or family friend. Once again keep your wits high and never offer information to the caller.

-Never wire the money under uncertain conditions. Once you wire the money, it is nearly impossible to trace or recover.

-If you happened to go through with it, call your local police and bank immediately. Bank staff are aware of these scams and will flag an unusually high transaction. Keep in mind though, that you are the owner of your own bank account so in some cases there may be nothing that can be done.

3. Telemarketing/Phone Scams

-Fake telemarketing calls selling products that don’t exist.

-Also come in the form of fake calls from the CRA (Canada revenue agency), your bank/credit card company, or police with a warrant out for your arrest unless you paid a sum of cash.

-Can You Hear Me Scam-Users respond “yes”. Scammers then record the users voice to get into bank and other personal accounts.

-Some even mimic fake charities and donations.

-Seniors make twice as many purchases by phone than the national average. Whether its from infomercials or call to order ads, seniors are more familiar with shopping over the phone.

-With no face to face interaction or proof of purchase, these scams are hard to trace.

-Once a deal has been made, scammers often share the information with other scammers to create a revolving door.

-As technology advances so do scam artists. It has been reported that scammers can mimic numbers from non-emergency lines, banks and even the police.

Solutions:

-Scammers always try to create a false deadline that pressure you into making a decision. Don’t play their game. Hang up immediately and report the number to the police. If the number comes up as unknown, private or with no caller ID, don’t bother answering. Block the number if you can.

-Remember, if they really need to get ahold of you, they will leave a message.

-If it is a bank trying to get ahold of you, you can always visit in person rather than give information over the phone.

-You can always visit the legitimate websites like the CRA and access your account from there instead of falling prey to a scam.

-A scammer will always want to keep you on the line. If donating to charity, you can at your convenience. Hang up and do your own research to figure out its legitimacy.

-As charity scams often come after natural disasters, donating to Canadian Red Cross, St. Albert or Edmonton Food Bank, or Stollery Children’s Hospital Foundation are all a legitimate start to providing donation aid.

-Your comfortability is what matters, don’t let scammers bully you. If you need to purchase something over the phone, you can most likely find it in store or on their online website. Companies like Amazon, Walmart and IKEA all offer online shopping that will ship directly to your home. Just be careful of fraudulent emails that mimic UPS, Fed EX or other parcel delivery companies.

-Like above if you do go through with the scam, contact your bank and police immediately.

4. Social Media Scams

-Scams directed towards users of social media such as Facebook, Twitter, Instagram etc.

-Scammers use the platform to upload viruses, ransomware or malware encrypted in messages, website links or advertisements.

Chain Letters:

-Takes the form of “retweet or repost this to give to X charity” or “Post this link to tell Facebook X”.

-By posting/reposting links to bogus websites often lead to viruses being installed or personal information being hacked.

Hidden Charges:

-Scammers often use fake quizzes and games to gain access to personal information.

-If you have ever seen a “What character are you quiz” or “play this hot new free mobile game that’s got everyone talking” or an article stating “5 reasons why X hate X”, you have most likely seen a scam.

-Once clicked on, these websites often ask for a phone number or email to continue reading. In reality, they are trying to sign you up for a hidden subscription. Don’t ever give out your phone number on a social media site.

-Legitimate websites that do offer quizzes such as Buzzfeed will ask if you want to sign up for a mailing list but they never force you to do so to access a quiz or news article.

Hidden URLs (web addresses):

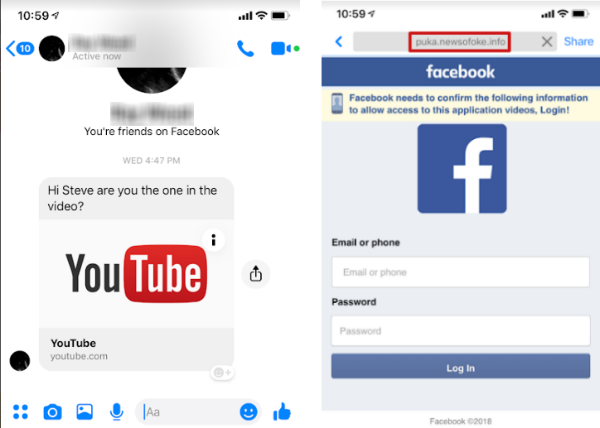

-Be careful of blindly clicking URLs. Shortened ones are often links to malware or websites that ask for your login credentials.

-Once you are logged into a social media site, there should be no reason to sign in again on another site. If a site asks you to do so, you will likely have your Facebook account hacked.

-Remember, sometimes your friends’ profiles have been hacked. Hackers often want to widen the net by tricking friends of the one who was hacked. If you ever see a status or message from a friend stating, “check out this cool video” or “you won’t believe this!” (also known as clickbait scams), don’t click on it or type in your log in credentials.

Check out below an example of a fake social media scam:

Solutions:

-Like above, install anti-virus software to avoid these issues.

-If you are logged into social media, there is no need to do so again. If you are brought to a site asking for log in credentials, don’t do it as it is likely a scam.

-Provide minimal information to social media in general. Remember most people have access to social media. Therefore, only add information you are comfortable with the world seeing.

-Use two-factor authentication. This involves connecting your account to a mobile phone or email to verify logins or account activity. Most of, if not all social media (as well as Google) sites use this feature to ensure the person logging into your account is you. This can only be done in your account settings on the social media site, never through another website.

-Keep your wits about you. what you see is not always truth, especially on social media. Don’t believe everything you see and remember to cross reference with other social media sites, news outlets and friends and family. Its easy to believe something on the internet without doing the appropriate research first.

-Educate others. Don’t accidentally spread fake news, or links to bogus sites. If you do not know what you are doing, ask for help from a caregiver, loved one or friend to ensure you are taking up the best practices.

-Don’t add people or accept requests from people you don’t know. As people are known to make fake accounts to prey on people, simply don’t accept requests from strangers.

-Don’t click on links unless you are sure it is from a genuine source. A good rule of thumb is it is usually ok to click links from large corporations such as YouTube, CTV News, or City of Edmonton.

5. Sweetheart Scams

-Can happen both online or in person.

-Very similar to catfishing (luring someone into a relationship by creating an online persona).

-Targeted to men and woman over the age of 40-usually the older the better, specifically widows or recent divorcees.

-The person meets attractive mate though a singles or online dating website.

-The couple exchange photos, chat and develop a relationship.

-Scammers usually send fake photos of a good-looking person typically younger in age.

-Scammers make sure to prey on the vulnerability of the senior to get them to genuinely fall in love and develop a real connection with their online sweetheart.

-The scam often takes a while to initiate as falling in love and trusting someone takes longer depending on the person.

-Eventually once the connection is made, the scammer comes up with a story of a problem that requires a monetary solution.

-The senior eventually forks over the money consistently to pay for their sweetheart’s problem.

-The money is often wired to an international account making it impossible to trace.

-Once the money is taken, the scammer will seize contact with the senior and disappear forever.

-In some cases, the scammer meets in person to sell the story even more.

Solutions:

-Be on your guard and look behind aesthetics. Whether its online or in person, deception can happen at any moment. Be careful with who you are interacting with and if something is too good to be true, it probably is. The best defense is using your common sense.

-Though there are some genuine relationships spanned across different ages, they are not common. As painful as it may be, ask yourself if it is appropriate that someone of a significantly younger age is interested in a romantic relationship with a senior. Is there a catch? Is there anything the younger individual wants? All these questions are important to ask yourself before jumping in feet first. If any of them end in monetary gain, you know you have run into trouble.

-Never transfer money to someone you do not truly know. Though it may be obvious, transferred money into unknown accounts, especially overseas, will likely never be seen again.

-Ask other about your interactions. If you have other family members or friends you can confide in, ask them about the experience you are having. Getting another trustworthy person’s opinion can always help to make sure you are making the right decision.

-Consult a professional if you think an online relationship seems questionable. Police are well acquainted with sweetheart scams and would be happy to help you identify the common signs to look for.

-Keep in mind scammers will use everything at their disposal. If you have a persistent online profile, they will use it to their advantages. Stealing online information is their specialty and tailoring it to your interests, likes and vulnerabilities will make the story all more believable.

-Do your homework. If something doesn’t check out, google it and make sure you cross reference the person you are meeting to see if they exist online. Remember, everything can be falsified so be careful.

-Pursue a face to face interaction. If possible, avoid online dating completely and enroll yourself in local speed dating or face to face dating. There are a lot of good online dating websites like Eharmony or Silver Singles, just, as always, proceed with caution.

-Most importantly, don’t feel ashamed by falling prey to a scam. It can happen to everyone and with ever changing technology, scamming has also evolved. Report any scam to the authorities immediately to help others with similar situations.

Scams can happen to anyone but with the right care and right practices in mind, this can be highly reduced. Senior Home Care by Angels can identify points of interest and vulnerability in everyday life and provide solutions to keep you safe from scams. Our experienced caregivers and client care services can show you ways to navigate the world wide web in a safe and secure manner.

Get all the information you need to help someone you love. Choose Senior Home Care by Angels-Canada’s choice in home care!

Reach Out Today

You can reach Senior Home Care by Angels here, or by phone at (780) 487-4256. We look forward to meeting you and your family and providing you with all the home care solutions you need!

Resources:

Top Internet Scams Affecting the Elderly

https://www.aginginplace.org/internet-scams-affecting-elderly/

https://www.forbes.com/sites/forbestechcouncil/2019/09/09/top-social-media-scams-and-how-to-avoid-them/#6506f630873d

https://www.safetydetectives.com/blog/the-ultimate-internet-safety-guide-for-seniors/

Government of Canada Fraud Facts

https://www.competitionbureau.gc.ca/eic/site/cb-bc.nsf/eng/04334.html

https://www.canada.ca/en/employment-social-development/corporate/seniors/forum/fraud-scams.html

Canadian Anti-Fraud Centre

http://www.antifraudcentre-centreantifraude.ca/index-eng.htm

The Worst and Most Common Telemarketing Scams

https://www.thebalance.com/the-worst-and-most-common-telemarketing-scams-1947468

What to do if you are a Victim of a Scam or Fraud

http://www.antifraudcentre-centreantifraude.ca/victim-victime/index-eng.htm

https://www.agingcare.com/articles/5-steps-to-take-after-clicking-on-a-phishing-link-178044.htm

https://www.consumerreports.org/scams-fraud/scam-or-fraud-victim-what-to-do/

http://www.rcmp-grc.gc.ca/scams-fraudes/victims-guide-victimes-eng.htm

https://www.edmontonpolice.ca/CrimePrevention/PersonalFamilySafety/Frauds/ReportingFraud

News Reports

https://globalnews.ca/video/6148447/calgary-police-warn-of-phone-scam-with-new-twist

https://www.alberta.ca/fraud-prevention.aspx

https://globalnews.ca/tag/alberta-fraud/

https://www.cbsnews.com/video/thief-caught-on-camera-in-grandparent-scam/

https://www.cbc.ca/news/canada/edmonton/can-you-hear-me-phone-scam-warning-bbb-1.3970312

![]()

Each Senior Home Care by Angels agency is a franchise that is independently owned and operated. The Franchisor, Visiting Homecare International Inc., does not control or manage the day to day business operations of any Senior Home Care by Angels franchised agency.